IT cost structure

What is IT cost structure?

IT cost structure refers to the relationship between different types of expenditures within a larger IT budget. It facilitates an understanding of the variable and fixed IT costs incurred by an organization.

Generally speaking, cost structure refers to a business's various costs and how they are categorized. In the context of IT, cost structure refers to a company's various IT expenses and how these expenses are related to each other, as well as to the business's overall IT needs and goals.

The IT cost structure can vary from one company to another, depending on their requirements and expenses. A company's understanding of its own unique IT cost structure can help determine IT-related expenditures and identify opportunities to reduce costs. Understanding the IT cost structure also helps with planning for new IT investments.

IT cost structure planning and decision-making

Effective planning for an IT cost structure should consider long-term business investments over several years, followed by the creation of line items in the budget that can be categorized and tied to specific costs.

The chief information officer (CIO) is normally primarily responsible for the strategic decisions in the IT department, including the IT cost structure, and determines which proposals fit within the IT budget. The CIO frequently collaborates with other senior managers such as the chief financial officer (CFO) and chief executive officer (CEO) to prepare and finalize the IT budget, and to make key decisions about the IT cost structure.

What are the four types of IT costs?

There are four categories that contribute to the overall IT cost structure:

- Operational costs, or the price of running IT services on a day-to-day basis.

- Staff costs, which include all expenditures associated with hiring, training and retaining an employee.

- Core costs, which represent the general operating expenses that have no direct relationship to the production or selling of a company's goods and services. These are also known as overheads.

- Costs, or money invested by a company to acquire or upgrade fixed, physical, non-consumable assets, such as buildings and equipment.

Cost analysts must be able to identify all these costs so they can understand the key variables influencing these costs and how those variables are subject to change. This information helps business leaders and decision-makers to predict IT costs and plan the IT budget accordingly. Understanding the IT cost structure also helps with capacity planning, enterprise asset management (EAM) and project planning.

Fixed IT costs vs. variable IT costs

Many IT expenses are fixed, which limits the options for IT executives looking to reduce expenditures. Fixed costs are generally long-term expenditures and don't change over time -- or at least don't change very quickly or to an appreciable extent.

Examples of fixed IT costs include the following:

- IT personnel salaries.

- Long-term software licenses.

- Hardware components of the IT infrastructure.

- Infrastructure maintenance expenses.

- Infrastructure depreciation.

- Lease payments.

By contrast, variable IT costs include expenses that change in the near term. These variations might be due to internal factors, such as changing business volumes or usage, or due to external factors, such as price increases or the emergence of new IT products or services.

Examples of variable IT costs include:

- Per-seat software licenses.

- Costs of hiring contractors or other third parties for short-term staffing requirements.

- Incremental server capacity added.

- Incremental hardware costs.

- Staff training and awareness programs.

- Travel expenses.

Converting fixed costs to variable costs

In some cases, organizations can convert hard-to-control fixed IT costs into more controllable variable costs. One way to do so is by adopting cloud technologies.

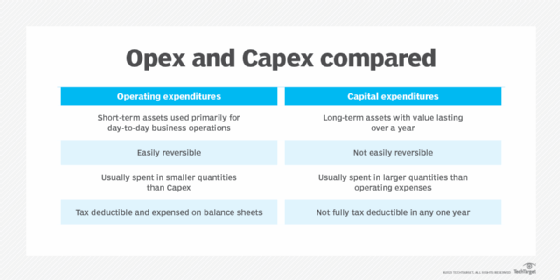

In traditional, on-premises IT environments, many computing costs are fixed, predictable and incurred over a long period of time. These costs are known as capital expenditures or CapEx.

CapEx requires large upfront cash investments and involves technology and vendor lock-in. It can be difficult to repurpose existing IT assets for new requirements, so businesses must often buy new equipment, which increases their CapEx.

Cloud computing removes many fixed IT costs by converting capital expenditures into operational expenditures (OpEx). OpEx refers to the costs of running day-to-day IT operations without the large upfront investments in hardware, software and networking. Most public cloud providers provide pay-as-you-go pricing, meaning organizations can use what cloud resources they require and only pay for the resources they actually use.

With this on-demand approach, businesses don't incur fixed, unchanging expenses on cloud-based IT resources. Rather, these expenses become variable depending on usage, which enables organizations to better control and optimize IT costs.

Another way to convert fixed IT costs into variable costs is through staffing changes. Hiring more external contractors instead of salaried employees enables organizations -- especially those under extreme cost pressures -- to convert fixed staffing costs into variable costs. Of course, shifting from full-time staff to external contractors can have a long-term negative impact, affecting an organization's ability to drive profitability and strategic advantage via its people. Companies must keep these considerations in mind before making the decision to convert staffing fixed costs to variable costs.

Changing the IT procurement model can also convert fixed costs to variable costs. It can reduce IT total cost of ownership. For example, adopting hardware-as-a-service enables organizations to lease hardware as required instead of buying it outright. Similarly, the software-as-a-service procurement model minimizes the need to buy software for the long term and instead, organizations pay for a subscription as required and only until it is required.

What is cost management in IT?

Cost management is the ongoing effort to understand, plan and control the various costs incurred by running a business. IT cost management is the process of doing all of this for IT-related costs.

The IT cost management process includes the collection and analysis of information about IT expenses, with the aim of forecasting and monitoring costs as well as preventing overruns of the IT budget. In the long term, effective IT cost management practices enable organizations to generate more savings and maximize returns on IT investments.

In building and trimming an IT cost structure, typical cost management initiatives include rationalizing IT assets and resources and renegotiating vendor contracts, especially around payment terms and discounts.

Organizations might also implement these IT-specific cost management initiatives to control and optimize IT costs:

- Simplify IT workflows to cut unnecessary, cost-increasing or unprofitable steps.

- Automate repetitive IT tasks, such as tasks related to software patching, or helpdesk.

- Outsource low-value tasks to external contractors.

- Forecast future expenses and build them into the IT budget.

- Join a buying group that negotiates discounts with suppliers on behalf of member organizations.

Learn eight ways to cut cloud costs and how FinOps can rein in cloud costs. Read about 14 potential costs of shadow IT. Check out four tips on how to reduce IT infrastructure costs and explore the hidden cost of maintaining legacy systems.