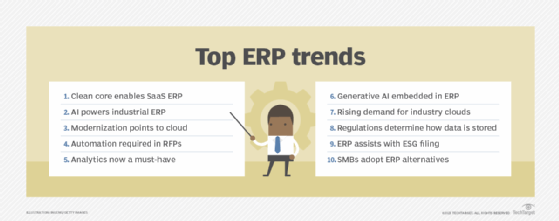

10 ERP trends for 2024 and beyond

AI-driven automation is fast transforming an ERP market that continues its long march to the cloud, as many buyers seek modernization, efficiency and help with ESG reporting.

ERP is no longer purely the province of the back office. Nowadays, it powers front-end functions like sales and marketing automation and e-commerce. It is an indispensable part of doing business.

According to research from HG Insights, the global ERP market has grown by 8% since 2022, and 1.4 million companies are expected to spend $183 billion on ERP software in 2024. As the market continues to grow, ERP trends will shift because of the influence of new technology, such as generative AI, and changing business requirements, including the reporting required by government regulations.

"It's a fun time in the ERP world," said Chris Perry, ERP lead in the M&A practice at the consulting firm West Monroe. ERP stagnated after the Y2K scare, but then large ERP vendors began snapping up companies with complementary technology, such as AI, Industry 4.0, SaaS and industry-specific ERP, Perry added.

While ERP may be viewed as a stalwart, relatively unchanging part of doing business, new developments and improvements in technology, along with what companies expect from their vendors, say otherwise.

This article is part of

The ultimate guide to ERP

Here's a look at the top ERP trends for 2024 and beyond that characterize the state of the art in ERP.

1. Clean core lays groundwork for SaaS ERP

In the past year or so, vendors have adopted a clean core deployment, used standard messaging and are developing artifacts and accelerators to get behind it, according to Perry. A clean core strategy involves standardizing ERP business processes and data and ensuring that any extensions and integrations follow cloud standards.

"It's important because the cloud and the clean core concept help us move toward a SaaS model," he added.

SaaS ERP will become more prevalent in 2024 and beyond because, as vendors develop new capabilities, they'll want to push them out to users quickly, according to Perry. In the old, on-premises world, users might have to wait two years to upgrade the system. But with SaaS, they can begin working with new features as soon as the vendor makes them available.

2. AI powers industrial ERP

As AI continues to gain adoption, companies will expect to see AI features in the ERP systems they're considering buying.

"AI-powered ERP systems would bring about significant advancements in efficiency, productivity and decision-making," said Campbell Tourgis, executive vice president and COO at industrial distributor Wainbee. "For instance, AI-driven demand forecasting will optimize inventory levels and reduce excess stock."

Tourgis noted that AI could spot defects and anomalies in products, improving quality, as well as access real-time monitoring of suppliers, logistics and production processes to identify potential delays. "We are planning to upgrade our ERP system to include more AI capabilities. I believe that integrating AI for dynamic pricing will maximize our revenue and competitiveness," he said.

3. ERP modernization leads to cloud ERP

"Globally speaking, a lot of ERP customers are on-premises," said Akshara Naik Lopez, a senior analyst at Forrester Research. These customers typically are on three-to-five-year upgrade cycles, but as they look to modernize their ERP systems, they're also looking at ERP in the cloud, she said.

In some cases, they might not stick with the same vendor. For example, a customer on Oracle or SAP on-premises ERP might consider a cloud-first ERP system from another vendor. "Despite economic conditions, we don't find organizations pulling back from spending. When it comes to their core enterprise, they're spending the money and doing their modernization projects for ERP," she added.

"Modernization and digital transformation mean different things to different customers, depending on what state they are at," Naik Lopez said. "At the end of the day, they want to make sure they're using the right applications in terms of how the market is evolving," as well as make sure they're investing in products they can use for the next 10 to 15 years.

4. Automation becomes a requirement in RFPs

Automation, especially robotic process automation and surrounding tools, used to be specific products or ERP projects, according to Naik Lopez. But now, the requests for proposal (RFPs) for ERP systems include enterprise performance management, analytics and automation.

"We are seeing less and less of RFPs that are just finance alone," she said. What used to just be ERP or human capital management has ballooned into other pieces, including automation.

5. Analytics are a must-have

Analytics are also becoming an added piece of ERP systems, as today's RFPs include them when companies are looking to modernize their software, Naik Lopez said. "They're getting those done when they're moving to the next product or application," she said. "There is definitely heavy demand for analytics."

6. Generative AI becomes embedded

Vendors have started offering generative AI capabilities in their products, an ERP trend that Naik Lopez doesn't expect to slow down. "They don't want their customers to worry about which model to use and which one fits best for what function, then worry about integrating," she said.

Instead, vendors are partnering with generative AI providers to embed the feature in their products. "Big ERP vendors are [entering] partnerships and will offer these capabilities to their customers in an embedded manner," she said.

7. Demand rises for industry-specific cloud

There is also a demand for more industry-specific cloud products, according to Naik Lopez, but it comes with a tradeoff. Industry-specific ERP products are a little more expensive than generic ERP offerings that can be customized. Potential buyers also need to be aware of a shortage of industry-specific skill sets if they go this route, she said.

However, ERP buyers are expected to adopt industry-specific cloud offerings at a rapid pace in the coming years, and IT service firms will provide accelerators to meet the demand. ERP vendors already sell some products that are tailored to certain industries, Naik Lopez said.

8. Regulations determine how data is stored

Organizations that operate in multiple countries, especially in the EU, will need to be cognizant of who accesses their data and how it's hosted, as sovereignty regulations are becoming stricter, according to Naik Lopez. Organizations will need to stay on top of new regulations and, from an architecture standpoint, engage in early design and planning for them.

Currently, EU data sovereignty regulations require European data to be stored on servers located in the EU, with some exceptions. The Data Act, along with the Data Governance Act and GDPR, tightened privacy controls and extended protections to IoT devices, which have become more prevalent in manufacturing and industrial applications.

9. ERP assists with ESG filing

The office of the CFO is being expanded to include tracking and reporting on sustainability, particularly in the United States. As environmental, sustainability and governance (ESG) reporting becomes more a part of doing business, ERP will naturally include these functions, as ERP has generally fallen under the CFO purview, Naik Lopez said.

"SAP has definitely taken a more intense route on providing more detailed carbon accounting, but it's still very new," she said. Other vendors are providing tools to help customers meet ESG filing requirements. Naik Lopez said she wouldn't be surprised if customers begin including sustainability and ESG as part of their RFPs for ERP products.

10. Midmarket adopts alternative ERP systems

While SAP, Oracle and other large ERP vendors offer solid products, they're not for everyone. In 2024, more buyers in the midmarket and below will be looking to alternative, cloud-first -- and even open source -- ERP products, according to Naik Lopez. SMBs do not want to spend 18 to 24 months to implement a system and are looking for quick wins. Cloud-first ERP systems have a lot of preconfigured templates and are less complex than offerings from large vendors, she said.

Ultimately, while ERP will continue to be an important part of many companies, the ERP trends for 2024 reflect a shift in how companies view ERP software and the capabilities associated with it. The increase in SaaS models, fueled by a clean core, is just the beginning when combined with generative AI, analytics and other capabilities to improve business processes and efficiency.

Christine Campbell is a freelance writer specializing in business and B2B technology.