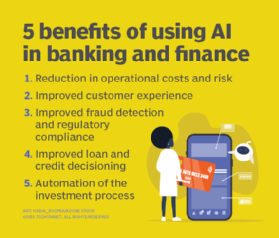

The top 5 benefits of AI in banking and finance

The strategic deployment of AI in banking and finance can bring substantial benefits. Learn about how AI tools are transforming financial services and the risks to be mindful of.

Interest in artificial intelligence technology is sky-high in the banking and finance sector.

The reason is not surprising. The strategic application of AI's many technologies -- including machine learning, natural language processing and computer vision -- can drive meaningful results for banks, from enhancing employee and customer experiences to improving back-office operations.

Cost savings connected to the use of AI can be significant. Accenture reports that "banks can achieve a 2-5X increase in the volume of interactions or transactions with the same headcount" by using AI-based tools.

Financial organizations have a leg up in taking advantage of AI, said Martha Bennett, a principal analyst at Forrester Research who specializes in emerging technologies. "One of the things AI needs is lots of data, and banks have lots of data."

Indeed, the use of AI and machine learning in banking services is not new. Payment companies, for example, have been using machine learning to detect and prevent fraudulent transactions for a while, Bennett said. And as computing power and storage have increased, detection increasingly happens in real time.

Regarding AI's capabilities, however, Bennett cautions "there is a lot of mythologizing around," including the notion that machine intelligence is on par with human cognition. "Machines are not intelligent," she said. And in areas where AI does surpass human abilities, such as predicting outcomes when there is a vast amount of variables, the cost of running the AI can exceed the benefits, she cautioned.

What are the top benefits of AI in banking?

What follows is a list of the top benefits of AI in banking and finance today and a discussion of some of the risks and challenges financial services companies face when using AI.

1. Reduction in operational costs and risk

The banking industry is largely digital in operation, but it is still riddled with human-based processes that sometimes are paperwork-heavy. In these processes, banks face significant operational cost and risk issues due to the potential for human error.

Robotic process automation (RPA), software that mimics rules-based digital tasks performed by humans, is being applied in banking to eliminate much of the time-intensive and error-prone work involved in entering customer data from contracts, forms and other sources.

Coupled with improved handwriting recognition, natural language processing and other AI technologies, RPA bots become intelligent process automation tools that can handle an increasingly wide range of banking workflows previously handled by humans. This definition of hyperautomation explains in detail the benefits of combining AI and RPA.

2. Improved customer experience with chatbots

There's a reason people derided banking hours. Banks never seemed to be open when you needed them most, such as later in the day or on holidays and weekends. Call centers of yore were notorious for long wait times and operators, when finally engaged, often couldn't resolve the customer's issue.

AI technologies are changing that.

Chatbots on call. One of the big benefits of AI in banking is the use of conversational assistants or chatbots. A chatbot, unlike an employee, is available 24/7, and customers have become increasingly comfortable using this software program to answer questions and handle many standard banking tasks that previously involved person-to-person interaction.

"Chatbots also aren't brand new and some banks have been using them for a while, both internally and customer facing, and getting benefits," Bennett said. The COVID-19 outbreak underscored their usefulness.

"They took a leap forward during the pandemic because anything that can be handled by a bot doesn't have to be handled by a person," Bennett said.

Upselling. In addition to fielding customer service inquiries and conversations about individual transactions, banks are getting better at using chatbots to make their customers aware of additional services and offerings.

For example, business customers might not be aware of merchant services and loan offerings that can help resolve payment or credit issues. Supported by predictive analytics and AI tools like and machine learning, chatbots (and customer service agents) can make the right offer on the right device in real time, delivering highly personalized service and potentially boosting revenue.

Still, Bennett said that financial services companies and customers should keep in mind that despite breakthroughs in natural language processing and natural language generation, most commercially deployed chatbots are "comparatively simple." They can deal with straightforward queries, but by and large, they are unable to understand context. That doesn't negate their value.

"Those straightforward queries can take up as much as 80% of the load in inbound questions from customers," she said.

3. Improved fraud detection and regulatory compliance

Fraud detection. Fraud detection is an area where machines are "genuinely superior to people," Bennett said.

"They can crunch vast amounts of numbers, applying different algorithms. They don't make mistakes, unless they're badly programmed," she said. Humans have a habit of making mistakes, especially with repetitive tasks."

Prior to the pandemic, the U.K.-based Bennett said she could be in a different country every day for work. Her credit card company's fraud detection had gotten so good that her card was never declined as she traveled from one geography to another. The one instance when there was fraud -- someone tried to buy a computer as she was buying cheese in Madrid -- she was contacted immediately.

"What I'm saying is that companies with well-structured, good data have already been able to put AI to good use in detecting fraud," she said. As companies improve their data collection and algorithms become more advanced, the benefit to financial firms is growing.

Regulatory compliance. Banking is one of the most highly regulated sectors of the economy, both in the United States and worldwide. Governments use their regulatory authority to make sure banks have acceptable risk profiles to avoid large-scale defaults, as well as to make sure banking customers are not using banks to perpetrate financial crimes. As such, banks have to comply with myriad regulations requiring them to know their customers, uphold customer privacy, monitor wire transfers, prevent money laundering and other fraud, and so on.

Banking regulatory compliance has significant cost and even higher liability if not followed. As a result, banks are using smart, AI virtual assistants to monitor transactions, keep an eye on customer behaviors, and audit and log information to various compliance and regulatory systems.

Big-data-enhanced fraud prevention has already made a significant impact on credit card processes, as noted above, and in areas such as loan underwriting, as discussed below. By looking at customer behaviors and patterns instead of specific rules, AI-based systems help banks practice proactive regulatory compliance, while minimizing overall risk.

4. Improved loan and credit decisioning

Similarly, banks are using AI-based systems to help make more informed, safer and profitable loan and credit decisions. Currently, many banks are still too confined to the use of credit scores, credit history, customer references and banking transactions to determine whether or not an individual or company is creditworthy.

However, as many will attest, these credit reporting systems are far from perfect and are often riddled with errors, missing real-world transaction history and misclassifying creditors. In addition to using data that's available, AI-based loan decision systems and machine learning algorithms can look at behaviors and patterns to determine if a customer with limited credit history might in fact make a good credit customer or find customers whose patterns might increase the likelihood of default.

The big challenge with using AI-based systems for loan and credit decisions is they can suffer from bias-related issues similar to those made by their human counterparts, an issue discussed below under "AI risks and challenges." This is due to how loan decision-making AI models are trained. Banks looking to use machine learning as part of real-world, in-production systems must try to root out bias and incorporate ethics training into their AI training processes to avoid these potential problems.

Explainability is also an issue when using AI algorithms using deep learning approaches. (See "What are the risks and downsides" below.)

5. Automation of the investment process

Finally, some banks are delving deeper into the world of AI by using their smart systems to help make investment decisions and support their investment banking research. Firms like Switzerland-based UBS and Netherlands-based ING are having AI systems scour the markets for untapped investment opportunities and inform their algorithmic trading systems. While humans are still in the loop with all these investment decisions, the AI systems are uncovering additional opportunities through better modeling and discovery.

In addition, many financial services companies are offering robo-advisers to help their customers with portfolio management. Through personalization, chatbots and customer-specific models, these robo-advisers can provide high-quality guidance on investment decisions and be available whenever the customer needs their assistance.

What are the risks and downsides?

Emerging technologies are risky due to their immaturity and the limited time they have been in action. The risks of using AI are compounded by the fact that the field is evolving so quickly. In addition to the benefits of using AI in banking, companies must also consider the following risks and challenges:

AI bias. As noted, AI bias is one of the biggest risks in using AI in banking. This is due to how decision-making AI models are developed, namely by humans who bring their biases and assumptions to the training of the machine learning model. These biases can be magnified when the model is deployed, sometimes with troubling results. This definition of machine learning bias explains the different types of bias that can inadvertently affect algorithms and the steps companies need to take to eliminate them. Once a model is trained, it must be continuously updated to accommodate new factors (e.g., COVID-19) and head off "model drift."

Explainability and ethics. Financial institutions operate under regulations that require them to issue explanations for their credit-issuing decisions to potential customers. This makes it difficult to implement tools built around deep learning neural networks, which operate by teasing out subtle correlations between thousands of variables that are typically incomprehensible to the human brain.

"You have to explain how an algorithm came to its decision," Bennett said. "I've been telling clients for years that saying 'The computer did it' doesn't sound good, and 'We have no idea why the computer did what it did' doesn't sound any better."

How to use AI responsibly is a topic of concern for companies, governments and other entities worldwide. In April 2021, the European Commission issued a proposal that addresses the risks of AI -- the first ever legal framework and likely just the start of governmental legislative work in this area.

Customer mistrust. In addition to complying with regulations, financial services companies must be mindful of customer trust when using AI tools. Chatbots prized for their convenience, for example, will cause customers to lose trust if they make mistakes, Bennett noted.

Cost. Finally, the pace of AI innovation is both exciting and costly, Bennett noted. There is often a lag between the time an algorithm is created in the lab and when it is deployed, simply because it is too expensive to run it. But even widely adopted algorithms can prove too dear to use profitably.

"We have come across companies that have actually switched off certain algorithms because the benefit they gained from running them did not outweigh the cost of running them," she said.